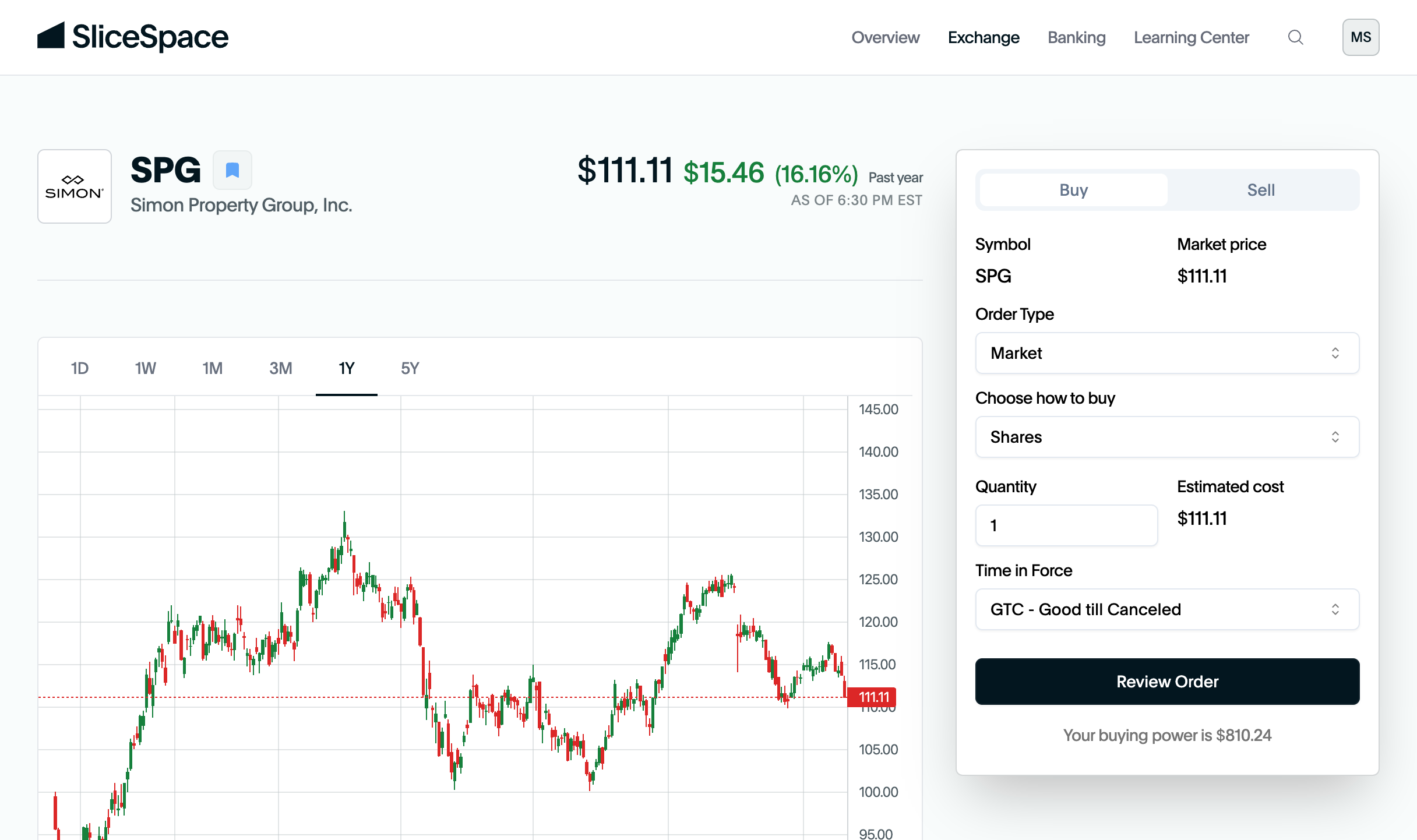

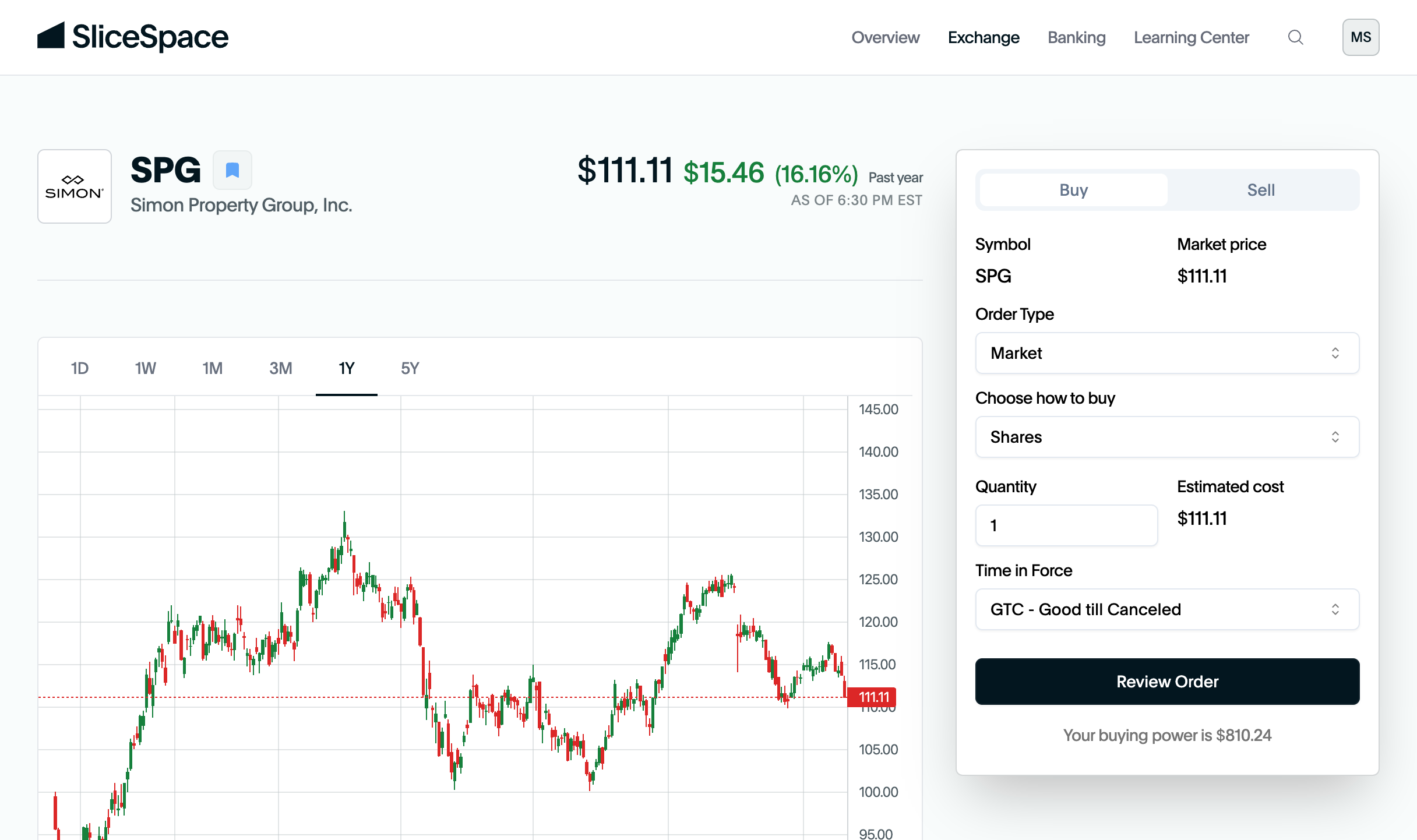

Real Estate Investing,

Simplified.

At SliceSpace, we imagine a future where anyone can be a real estate owner — allowing people to own a slice of the buildings they work in, the apartments they live in, and even their favorite venues.

At SliceSpace, we imagine a future where anyone can be a real estate owner — allowing people to own a slice of the buildings they work in, the apartments they live in, and even their favorite venues.